In aerospace manufacturing, the performance and reliability of components is paramount to delivering safe journeys, even in the face of extreme friction and temperature. But the challenges don’t end there. Environmental regulations and increased competitiveness within the industry mean that manufacturers must find efficiencies in all areas, making innovation and collaboration more crucial than ever. That’s why, when the time came for a world-leading aerospace manufacturer to review their surface finishing process, they turned to the market leader in selective plating to find an innovative solution.

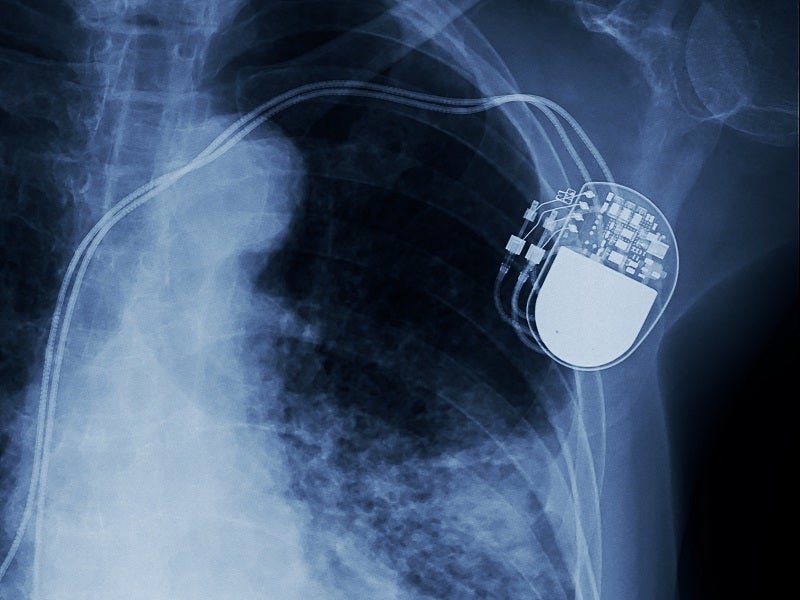

Aerospace is an industry like no other, particularly with regard to surface finishing. Renowned – and rightfully so – for its robust standards around the manufacture, repair and maintenance of aircraft components, the industry places great demands on manufacturers. The performance of components mustn’t be compromised in the face of friction, extreme temperatures and corrosive environments, all of which they are exposed to daily. Alongside performance, the manufacturing process itself must adhere to stringent health and safety requirements.

In recent decades, this market-leading aerospace manufacturer has seen their surface finishing processes evolve as they’ve strived to achieve greater component performance for their customers – from brush plating in the 1980s to in-house tank plating thereafter. Now, as industry demands have become even greater and components are required to operate in ever-more challenging environments, a new approach was needed.

Automating the process

Automated processes are now the standard in many manufacturing facilities. SIFCO ASC’s collaborative approach to automating the selective plating process enables users to realize ergonomic, financial and manufacturing performance-related benefits.

This manufacturer required nickel plating on their internal and external diameters for a prebraze application. Automating the selective plating process provided the main benefits this manufacturer was looking for: decreased ergonomic risk, traceability and repeatability of the process, and increased quality outcomes.

As standard, selective plating uses a low volume of chemicals, reducing both the environmental and cost concerns associated with tank plating methods which can result in excessive material and environmental costs and waste. Additional, the custom design of the machine provided unique features and allowed the manufacturer to realize even further benefits in approximately half of the footprint once held by their tank plating line. By using a Fanuc robot with built-in tool changers and tooling storage, the automated selective plating process provides complete flexibility. RFID tags significantly reduce the potential for human error by ensuring tooling is plating the correct part, tracking chemical usage and wrap wear, and facilitating the process to handle a variety of products while ensuring consistent quality. What’s more, the manufacturer was also able to completely remove their scrubber system from service. By using portable filter exhausts, they are more energy-efficient and have lower operating costs.

Now fully operational, the automated selective plating machine provides SIFCO ASC’s customer with a highly reliable and precise process, bringing its onsite component plating process in line with their reputation as a leading manufacturer in the aerospace industry. The results are clear to see: the surface coating is highly uniform; quality is consistently high; chemical usage can be precisely monitored; production is robust and levels of output consistent, and operator safety has been improved.