On 1-31 March every year, we celebrate Women’s History Month to recognise the achievements of women all over the world.

While it is important to acknowledge the accolades of all women, we are focusing on those working in science, technology, engineering and math (STEM).

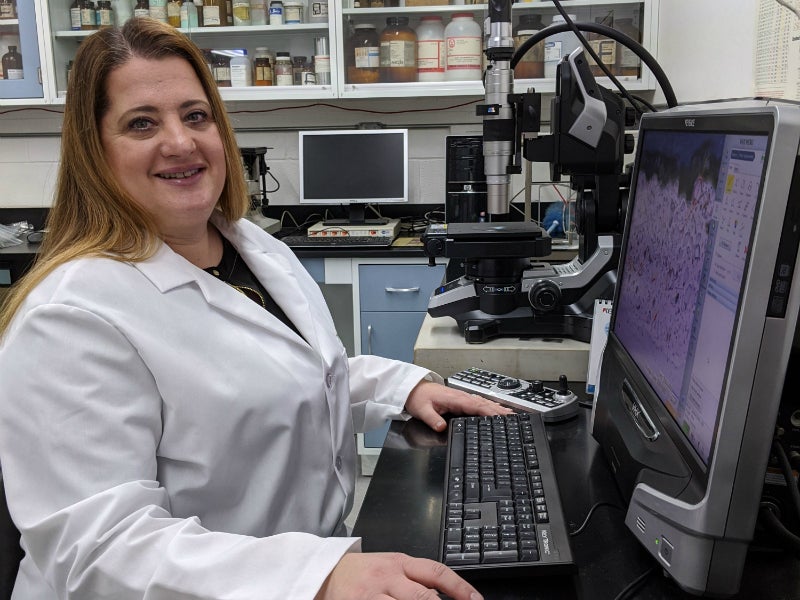

It is no secret that the world of STEM has been a men’s club for decades, with only 28% of women making up the workforce as opposed to 72% of men. To show that this gap is slowly but surely closing in, we have shone the spotlight on Danijela Milosevic-Popovich, a Research and Development Manager at SIFCO Applied Surface Concepts (ASC).

Danijela graduated from the University at Buffalo with a Bachelor of Science and Master of Engineering in chemical engineering. She then continued to earn her Master of Engineering Management from Ohio University. Before becoming part of the team at SIFCO ASC in 2005, she worked in the semiconductor and rubber industries.

From talking about how to remove the glass ceiling for women in engineering to changing the future of electroplating, we found out what inspires Danijela, and how she strives to create a better future for herself and other females in STEM.

Danijela knew she wanted to work in a STEM field since she was young. Her passion for science and math started in grade school. She loved the challenge of figuring out equations, learning theories and knew from very early on that having a background in science would provide her with a strong foundation no matter what career path she followed.

Her father – her biggest cheerleader and inspiration – always motivated her to advance her education and strive for independence. Growing up in the Balkans, it was not common for girls to go to college and, while his support of her continued studies was considered a taboo, he never let the criticism distract her.

Danijela said: “I believe a strong STEM background helps train the brain to think more critically. Intuition and critical thinking together create the perfect storm of problem-solving and I believe math and science are key building blocks to perfect this process.”

While there’s still a long way to go before we close the gap of women working in these fields, the number of women awarded STEM degrees every year has increased by over 50,000 in the past decade.

Danijela embarked on her last master’s degree when she was pregnant with her first daughter and continued to study and work full time. Driven by her passion to expand her horizons and learn as much as she could, she persevered.

This story echoes a similar message that Audrey Gelman, CEO of The Wing told when she became the first visibly pregnant woman to grace the cover of Inc. Magazine. Gelman wanted to show that women can ‘take greater professional risks whilst also not shelving their dreams of becoming a mother and starting a family.’ After all, if men can have it all, why can’t women?

When asked about her day-to-day role at SIFCO ASC, Danijela lights up as she talks about all of the areas she is involved in.

Danijela said: “Every day brings something new to the table. My role encompasses so much more than traditional R&D activities. It is multifaceted and keeps me on my toes. My department and I are the repositories for technical know-how, which ultimately leads to growing the knowledge base capabilities of our existing product lines and the development of new applications, plating solutions and technology.”

Through this research and knowledge base, Danijela and her team are slowly changing the perception that brush plating is a dirty, uncontrollable and manual process. Advancements such as programmable power packs and process automation have not only revolutionised the way electroplating is done but has given repair engineers even more control.

Danijela explained: “As we have developed various plating applications, we have been able to introduce more controls to the processing phases. As a result, we have refined the plating process parameters to provide repeatable and controllable deposit characteristics for a process that is traditionally manually performed by an operator. This level of control has propelled us to further develop semi and fully automated plating applications and equipment along with going away from traditional brush plating by developing encapsulated plating technologies.”

Working with a team of engineers, Danjiela develops Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)-compliant brush plating alternatives to the toxic chemicals that are currently in use across the world.

For example, cadmium and hard chrome are commonly used by maintenance repair engineers who are undertaking component repairs for a wide range of industries due to their increased wear resistance, surface hardness and durability. However, exposure to both metals in their compound state can be incredibly harmful to both plating technicians and the general public as they are carcinogenic.

When asked the question ‘what are the challenges of being a woman in STEM?’, Danijela says they are the same stereotypical barriers that have been internalised over several decades. She talks about the unconscious bias where both men and women are conditioned to think that men are more inquisitive, motivated and in charge. As a result, women have to work harder.

However, she muses that if we change the narrative, we may be able to remove the glass ceiling for both women and minorities in STEM, if we start to celebrate their accomplishments rather than the challenges they face.

She said: “Every woman in a STEM field has a unique set of challenges ahead of her that no man will ever have to experience. I would like to shine a spotlight on the accomplishments of women in STEM historically so that we can lay a framework for continued recognition of our girls as they turn into women and change the world alongside their male colleagues.”